Here are the Rewards Canada Top 5 Credit Card Sign Up offers for the month of January 2020! This is not a 'best' credit card

list like our

Top Travel Rewards Credit Card rankings but instead a look at cards that have very good acquisition (welcome/sign up) offers. As always when

choosing a card

you should always take other factors into account other than the

just sign

up bonus, but when some of these cards are first year free, they

can and

do pay off even when you grab them strictly for the sign up rewards. This month we actually only see one first year free card on the list!

No change this month from December although we should give an honorable mention to the CIBC Aventura Visa Infinite Privilege Card as it can push a decent value of over $500 but don't play your redemptions right and you could end of with a value of only $1. Also note that we are early in the month and some offers are slated to change in the next couple of weeks so keep an eye out for those. In general we should see some really great offers in 2020 thanks to the new Air Canada Aeroplan program launch.

Remember as well that you will find this list smack dab in the middle of the

Rewards Canada homepage for

easy reference!

Here are our top 5 credit card sign up offers for January (in order of welcome bonus value, calculated as minimum mile/points value minus annual fee

Marriott Bonvoy American Express Card - 50,000 Points

Marriott Bonvoy American Express Card - 50,000 Points (

Apply here)

No changes to this card means it stays put on the list The 50,000 points, awarded after

spending $1,500 on the card in three months are worth at least $500 in

our minds which means after subtracting the annual fee you are coming

out ahead by $380. In reality you can pull even more value out of the card (into four figures) as we outlined in our post

A look at how The Marriott Bonvoy American Express Card provides huge value! Don't forget you get an annual free night with the card as well on the card anniversary date!

Minimum Income: N/A

TD Aeroplan Visa Infinite Card - 30,000 Miles

TD Aeroplan Visa Infinite Card - 30,000 Miles (

Apply here)

This is the only first year free card on the list this month and if you are just starting out I would recommend getting this card first thanks to that annual fee waiver! The

bonus is awarded as follows: 15,000 Aeroplan Miles when you make your

first Purchase with your Card + 5x Aeroplan Miles on all purchases per $1,000 in the first three months (up to 15,000 miles) Depending on how you redeem those Aeroplan miles should be

worth no less than $360 but more likely closer to $800 or more! In fact

if you take the per mile value from

our post from late July this welcome bonus would be worth $1,800 or more.

Minimum

Income: $60,000

Personal or $100,000 Household

Alaska Airlines World Elite Mastercard - 30,000 Miles (

Apply here)

This card offers a welcome bonus of 30,000 miles when you spend $1,000 on the card in the first three months of having it. This is one of the easiest bonuses to achieve and this card is one of the most churnable in Canada. There are really no problems in getting it 2-4 times in one year alone! Those 30,000 miles are worth no less than $330 when redeeming for economy class flights and just go up from there like the TD Aeroplan card.

Minimum

Income: $80,000

Personal or $150,000 Household

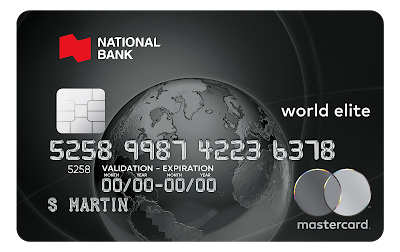

National Bank of Canada World Elite Mastercard - $480 Cash Back (

Apply here)

This

card's offer hasn't changed in a few months so it retains its spot in the list. You will get $40 cash back for each

month you spend $500 on the card in the first 12 months. This will give

you $480 in rewards but then subtracting the annual fee of $150 you are

coming

out ahead by $330.

Minimum

Income: $80,000

Personal or $150,000 Household

BMO AIR MILES World Elite Mastercard (

Apply here)

This card offers a welcome bonus of 3,000 AIR MILES Reward Miles, split between 1,000 on first purchase and 2,000 more when you spend $3,000 within 3 months of getting the card. The annual fee of $120 is waived in the first year as well meaning these miles come to you at no cost other than card spend. Those 3,000 miles are worth $330 at a minimum when redeeming towards travel.

Minimum

Income: $80,000

Personal or $150,000 Household

If you went for all these cards you ultimately could end up with

anywhere from $1,700 to over $3,000 in travel value. However even if you only take

on

one or two you are helping your travel budget significantly at no cost

other than regular credit card spend. We don't really recommend getting

all five in one month unless you know you can meet the minimum spend for

them all at once, rather you'd want to pick one or two right now,

perhaps another next month and so on.

Disclaimers:

American Express is not responsible for maintaining or monitoring the

accuracy of information on this website. For full details and current

product information click the Apply now link.

Sponsored advertising. The Toronto-Dominion Bank (TD) is not responsible

for the contents of this site including any editorials or reviews that

may appear on this site. For complete and current information on any TD

product, please visit the TD site.