There is only one no annual fee hotel credit card in Canada and that is the MBNA Best Western Mastercard®. This card has been around for quite sometime now and has survived the turmoil seen in our market for hotel loyalty program co-brand credit cards. Just a few years ago we had no less than half a dozen hotel card to choose from but that has now dwindled down to two - well actually three if you include the business version of the Marriott Bonvoy American Express card. Both the Best Western and Marriott cards have definitely fit a niche in the Canadian market which have helped them outlast all the other hotel cards we seen come and go and the Best Western fills that no annual fee, road warrior, not looking for luxury travel niche perfectly. In fact this card has ranked in the top three in our annual rankings in the no annual fee travel rewards card segment so there is something to attest to here.

Overview

The MBNA Best Western Mastercard

is the only publicly available credit card in Canada that you can earn

Best Western Rewards points with. It carries no annual fee and earns

points on all purchases that can be used to redeem for free nights at

Best Western hotels, converted to airline miles or for gift cards. Best

Western is one of the largest hotel chains in the world and has a

significant presence in Canada, especially in smaller towns so the Best

Western Rewards program and this credit card is ideally suited for those

cross Canada travellers and road warriors.

Costs & Sign up Features

As previously mentioned the MBNA Best Western Mastercard has no annual fee so there is no cost associated with the primary or any supplementary cards.

The standard welcome bonus for this card is 20,000 Best Western Rewards points which you receive on your first purchase with the card. In reality that means you could simply make a $1 purchase and you'd receive those points. Those 20,000 points are worth at least $160 in our books since we value Best Western points at a minimum of 0.8 cents each but you can definitely get more value than that depending on where and when you redeem those points.

The interest rate on the card is 19.99% on purchases. 22.99% on cash advances and balance transfers. These rates are equivalent to many cards at this level.

Earning

The card earns Best Western Rewards points on all eligible purchases and are deposited to your Best Western Rewards account a few days after your statement posts. Earn rates are as follows:

5 BWR points for every $1 you spend at participating Best Western properties

1 BWR point for every $1 you spend on all other eligible everyday purchases

The earn rate for stays at Best Western Hotels is really nice - essentially at least a 4% return and shows how this card is targeted towards the loyal Best Western traveller. The rest of the spending on this card however does leave something to be desired, 1 point per dollar providing about a 0.8% return (yes it can go higher than that) is so-so for a card with no annual fee but there are other no annual fee cards that provide higher returns of at least 1%. Ideally we'd love to see MBNA and BW raise the everyday earn rate to 2 points per dollar to be more competitive.

Point Valuation Chart

| Spending Category | Points earned per dollar spent | Approximate minimum return when redeeming for Best Western Free Night Awards* |

|---|---|---|

| Best Western properties | 5 | 4% |

| All other spending | 1 | 0.8% |

| * We value Best Western points at a minimum of 0.8 cents each hence the valuations above - that is a minimum though as we typically see higher value than that, in fact we've seen redemptions in excess of 1 cent per point so you could increase those values seen above | ||

Redeeming

Being a hotel card means the points earned go directly into your Best Western Rewards account. From there you can redeem the points for free night awards at over 4,700 Best Western Hotels worldwide, convert the points into frequent flyer miles/points for over 13 global airlines programs including Air Canada Aeroplan, American AAdvantage and British Airways Executive Club. Best Western also has redemption options for Best Western travel cards as well as gift cards from merchants like Amazon.ca and the Canadian Automobile Association.

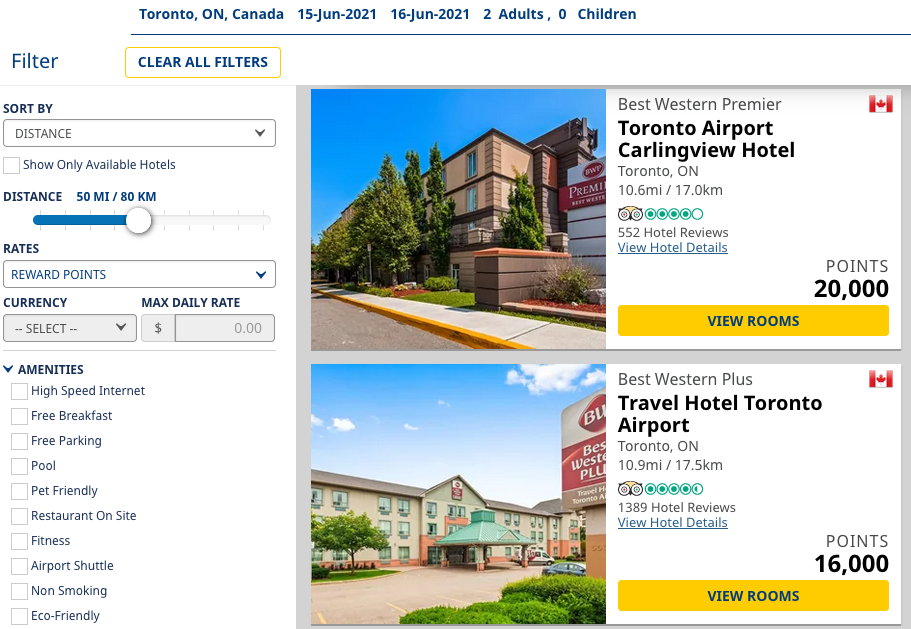

First we'll look at the primary redemption option - free night awards. The main premise of any hotel frequent guest program is to earn points that you can redeem for free night stays at hotels within that program. You can redeem your Best Western Rewards points for free night awards at over 4,700 hotels in over 100 countries. Unlike many hotel programs, Best Western Rewards free night award redemptions do not follow a category chart with set values being published. Instead hotel free night award pricing will vary at each location based on the season, availability and prevailing cash rates. That being said we do know that Best Western has set minimum and maximum pricing for free night awards from 5,000 points to 70,000 points per night. The good news as well is that a lot of their hotels tend to fall into the lower have of that point spread. To find out how many points you may require for free night awards simply go to Bestwestern.com and search for the hotel or region you are interested in and select "Rewards Points" as the rate you would like to be displayed.

An example of searching for hotels using the Rewards Points rate

You can see that if you are lucky enough to find free reward nights at 5,000 points you can get a lot of value out of the welcome bonus - four nights in fact. Your best bet to achieve something like that is for redemptions in Southeast Asia as that's where historically we have found 5,000 point nights.

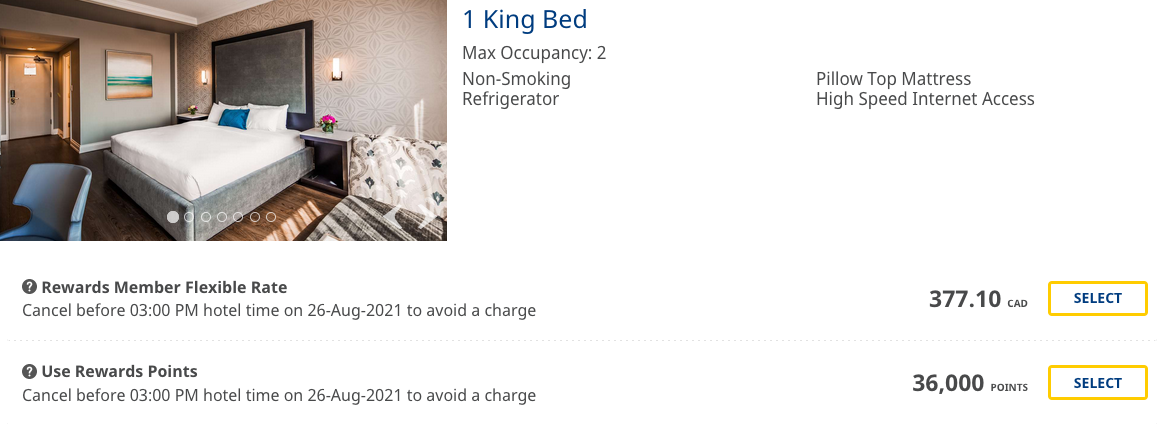

Closer to home you may get the best value out of your points at

select big city locations that charge more. For example here is a stay

at the Georgian Court Hotel in Vancouver for an August 2021 high season

stay:

From the above example you can see it is 36,000 points per night and like many hotel programs that includes all taxes and fees so that is all you pay. The cash rate for that same room is $377.10 which actually comes to $443.10 with taxes and fees. So you are redeeming 36,000 points for $443.10 in value or 1.2 cents per point. That's a really good redemption in the Best Western Rewards program. If you take your 5 points per dollar earned at Best Western that works out to a 6% return on that spending and all your other spending at 1 point per dollar works out to a 1.2% return. That's pretty respectable for a no fee card. As you can see, if you are about maximizing value it simply takes a little time and research to find those redemption options that do reward you handsomely.

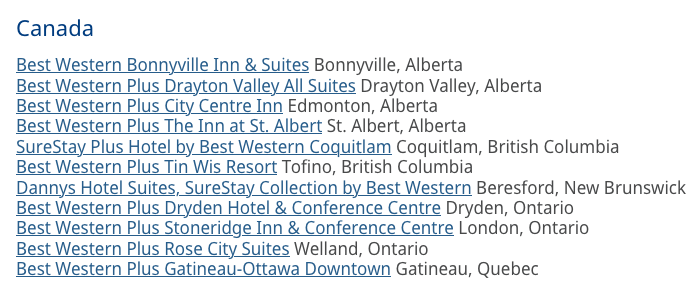

Best Western also recently launched a Pay with Points feature. This reward feature allows you to redeem points at check out towards the cash rate that you are paying for a stay at select Best Western Hotels in Canada and the U.S. You have to redeem a minimum of 5,000 points and they will give you $5 off for every 1,000 points you redeem. At the time of publishing this article these were the Canadian hotels participating in the Pay with Points reward option:

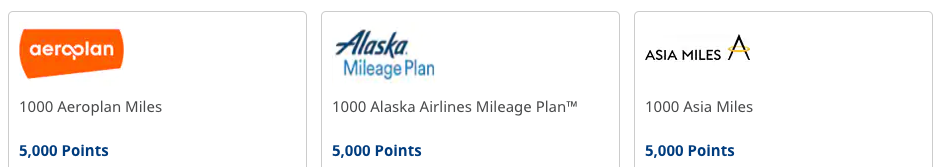

The next redemption option from the Best Western Rewards program is the transfer option to 13 airline frequent flyer programs. It is well known that outside of Marriott's Bonvoy program that most other hotel programs don't have very good conversion rates to airlines and this includes Best Western. That being said, it is an option and is always a good one if you know you'll never use your points for a free night stay which kind of defeats the purpose of having this card however there is one exception. This card is a Mastercard - that means you can use it at Costco as Costco only accepts Mastercard and this means the MBNA Best Western Mastercard is the only card that can earn you Aeroplan points, British Airways Avios and several other airline currencies here. The conversion ratio for most Best Western's airline partners is 5 to 1 with a minimum redemption of 5,000 points. This means the 20,000 point sign up bonus is worth 4,000 Aeroplan Points, American AAdvantage Miles, British Airways Avios etc. And since the card is free - those are free points and miles to add to your frequent flyer accounts. Of course on your spending this means you are only earning 0.2 to 1 mile/point per dollar but if you are only using one program like Aeroplan then earning those 0.2 Aeroplan points for your Costco purchases may be worth it for you.

A small sample of the airline transfer options

The last redemption option with Best Western Rewards is redeeming points for Best Western Travel Cards (essentially gift cards) and gift cards from retailers like Amazon.ca and the Canadian Automobile Association. Like most programs these last type of redemptions provide the least amount of value. For example a C$250 Best Western Travel card will set you back 37,500 points or a 0.67 cents per points value. That's less than our minimum 0.8 cents value for redeeming for a hotel stay and quite a bit less than our Vancouver example above. For Amazon.ca gift cards or prepaid Mastercards it is even less, you have to redeem 12,000 points for every $50 in value or 0.41 cents per point.

Features and Benefits

One of the trade offs with no annual fee cards is that they typically don't have very many features and benefits. Such is the case with the MBNA Best Western Mastercard but it does have some. Does it have a lot of benefits? No, but it's one key benefit is fitting to the traveller who stays at Best Western Hotels and that is elite status. The card provides automatic Gold Elite status with Best Western Rewards. Now Gold status with Best Western isn't a highly sought after status but it does give you a 10% boost in points that you earn on Best Westerns stays plus bonus points and complimentary water on Best Western stays. However, spend $10,000 on your MBNA Best Western Mastercard in a year and you'll jump up to Best Western Diamond elite status, this is the second highest level in the program. Again though not much is added here outside of a healthy boost 30% extra points on your Best Western stays. So if you have this card and do frequent stay at Best Western Hotels you can earn quite a few more points by having elite status.

On the insurance side the card has OK coverage which actually isn't too bad for a no fee card. Coverage includes travel accident insurance,trip interruption, car rental CDW coverage, purchase protection and extended warranty.

What is good about this card

The first thing that is good about this card is the welcome bonus - 20,000 Best Western Rewards points can be had with a simple $1 purchase and nothing else. No annual fee. Nothing. So that's like getting at least $160 in value or 4,000 Aeroplan points for buying one chocolate bar.

The next good thing about this card is the earn rate at Best Western Hotels. 5 points per dollar is a great earn rate that provides a lot of value. As you can see if you frequent Best Western Hotels having this card can really make sense as the points will add up fast and those Best Western stays will be netting you on average a 4% return but even as high as 6% as we show above.

While Best Western Elite Status isn't like the elite statuses we see from other hotel chains it is still a nice benefit to get from the card so that you can earn extra points on your Best Western stays.

It's a Mastercard which means you can use it at Costco!

What is not so good about this card

The base earn rate is the biggest drawback on this card. Earning only one Best Western Rewards points per dollar is relatively weak. Yes we do show how it can be a 1.2% return but for the most redemption option you'll be lucky to max out at 1%.

Not much in terms of added benefits or features. The elite status being the only benefit being added to the card and the insurance package is average. If insurance is key there are other no annual fee rewards cards that do provide better insurance options.

While there are a lot of hotels to choose from for free night awards and other rewards to use your points, overall your redemption options are limited. If you are someone who doesn't like to be tied into one program or that program's partners you'll be better off with a card that has more flexible reward options.

The conversion rate to airlines is pretty abysmal but as we

mentioned for some select type of purchases and programs this card is

your only option.

Who should get this card

- Best Western Rewards point collectors - if you frequently stay at Best Western Hotels your best bet is this card to pay for those stays with its accelerated earn plus earning those points on other purchases as well will boost your BWR balance handsomely.

- People who want a no annual fee Mastercard in the their wallets

- People who are looking for a Mastercard to use at Costco (or other Mastercard only merchants) so they can technically earn Aeroplan points or other airline miles/points on those purchases

Conclusion

The MBNA Best Western Mastercard is one of the longest running co-brand cards in Canada and must be popular enough for it to keep going like it has. We've seen numerous other hotel co-brand credit cards come and go but not this one and that's because it fills its niche nicely. Best Western has a great presence in Canada, has a recognized brand name that is actually the name of their hotels (not like IHG or Choice, whose cards failed in Canada) and thus they have an associated credit card that works here. It does fill a bit of a niche in that it is best suited for the Best Western traveller but it also known in the points collectors circles as your only Mastercard option to earning select airline points and miles and thus finds its way in the wallets of Air Canada Aeroplan and other airline currency collectors. Ultimately, being a no annual fee card it is actually an awesome option to have in your wallet since there are no carrying costs - you don't have to pull it out and use it very often to justify having it. It's there for when you need it and that's why this card ranks higher up in the No Annual Fee Travel Rewards Credit Card category!

No comments:

Post a Comment