Falling into the Rewards Canada "Hotel" category the consumer version of this card used to always take top spot in that category in our annual credit card rankings. However with the demise of most hotel credit cards in Canada we no longer have a hotel category. However the consumer version still ranks in the Top 5 Cards overall in Canada so in reality this card is right there as well since s it is very similar to the consumer Marriott Bonvoy American Express Card.

Overview

The Marriott Bonvoy Business American Express Card is kind of an unknown under the radar small business card here in Canada. Often overshadowed by the consumer version of the card and

other Amex business cards this card is definitely under appreciated. It

shouldn't be though! Knowing how popular the consumer version of the

card is this card should be just as popular. It features everything the

same and more - that more is increased earn rates for gas, dining and

travel purchases! Yes the annual fee is higher so that is trade off for

the increased earn rates. If you are Marriott Bonvoy fan that loves

amazing free night stays or enjoys the option to convert those points to

over 40 different airline programs this card is one that you shouldn't

overlook since you can hold it in addition to the consumer card. It is in fact one of the best business credit cards in Canada.

Costs & Sign up Features

The Marriott Bonvoy Business American Express Card comes with a $150 primary card annual fee which is higher than a lot of cards that could be comparable in terms of benefits. Supplementary cards are $50 each which is pretty standard for additional cards for both personal or small business accounts.

NEW LIMITED TIME WELCOME OFFER:

- Earn 60,000 Welcome Bonus Marriott Bonvoy™ points after you charge $5,000 in purchases to your Card in your first three months of Cardmembership. Offer subject to change at any time

- Plus, get a $150 statement credit when you charge $15,000 in net purchases to your card in your first twelve months of Cardmembership. Offer subject to change at any time.

Those 60,000 points are worth at least $600 in our books since we value Marriott Bonvoy points at a minimum 1 cent each but you can get much more value out of them than that!

The interest rate on the card is 19.99% on

purchases. 21.99% on cash advances and balance transfers. These rates

are equivalent to or below many cards at this level. Just like all

American Express cards there is no minimum income requirement. Approvals

will be based upon credit history and other factors.

Earning

The card earns Marriott Bonvoy points on all eligible purchases and are deposited to your Marriott Bonvoy account a few days after your statement posts. Earn rates are as follows:

5 Marriott Bonvoy points for every $1 you spend at participating Marriott Bonvoy properties

3 Marriott Bonvoy points for every $1 you spend on gas, dining and travel

2 Marriott Bonvoy points for every $1 you spend on all other eligible everyday purchases

These are pretty amazing earn rates - in fact the 2 points per dollar on all other spending ties the consumer Marriott card as the best card out there in terms of noncategory bonus spending. Very few cards award the equivalent of a 2% return on base level spending and in most cases when you redeem via Marriott you should easily be able to get more than 1 cent per point hence a return of over 2%.

Recommended reading: The top credit cards for everyday non-category bonus spending

Add on top of that great earn the accelerated earn rates of 3 points per dollar on gas, dining and travel. Plus of course the exclusive 5 points per dollar when you spend at Marriott and you can see that this card is major points earner.

Point Valuation Chart

| Spending Category | Points earned per dollar spent | Approximate minimum return when redeeming for Marriott Free Night Awards* |

|---|---|---|

| Marriott Bonvoy properties | 5 | 5% |

| Gas, dining and travel | 3 | 3% |

| All other spending | 2 | 2% |

| * We value Marriott Bonvoy points at a minimum of 1 cent each hence the valuations above - that is a minimum though as we typically see higher value than that, in fact we've seen redemptions in excess of 3 cents per points so you could triple those values seen above. | ||

Redeeming

Being a hotel card means the points earned go directly into your Marriott Bonvoy account. From there you can redeem the points for free night awards at nearly 8,000 Marriott Hotels worldwide, convert the points into frequent flyer miles/points for over 40 global airlines programs including Air Canada Aeroplan, Cathay Pacific Asia Miles or United MileagePlus. Marriott also has redemption options for Marriott Travel Packages, gift cards, flight+hotel packages and the very famous Marriott Bonvoy Moments.

Recommended reading: Marriott's New Hotel Openings in Canada for 2021 - 9 hotels in the works including the W Toronto & Humaniti Hotel Montreal

First we'll look at the primary redemption option - free night awards. The main premise of any hotel frequent guest program is to earn points that you can redeem for free night stays at hotels within that program. This is where Marriott Bonvoy excels. Being one of the largest hotel chains in the world with nearly 8,000 hotels there are a lot of locations to choose from to redeem those points. Like many hotel programs the free night award redemptions follow a category chart where there are set values for the points required for hotels that fall into each category. Marriott has eight categories with Category 1 being the lower end hotels and Category 8 comprising of those dream worthy ultra luxurious properties.

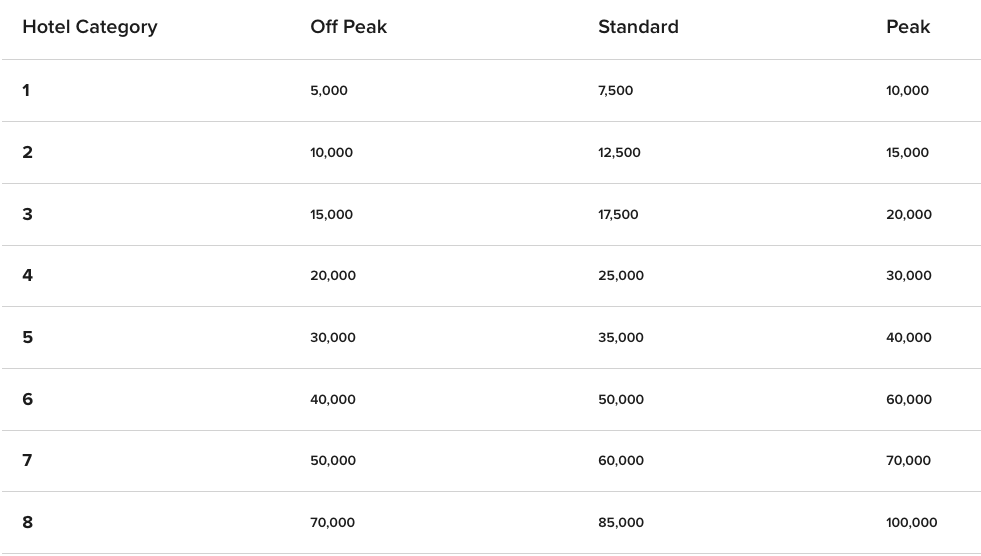

Here are the current redemption rates for each Marriott Bonvoy category:

As you can see there are three levels in

each category: Off Peak, Standard and Peak. For the most part most

redemptions will fall into standard but during slower time periods you

may find the lower Off Peak rates and conversely during busy times you

could expect to pay Peak pricing. Marriott also runs PointSavers which

provides up to a 20% discount on the above rate at select hotels during

select times of the year. If you are lucky enough you could redeem as

little as 4,000 points for a night at a Category 1 hotel. The third

hotel redemption option after the above rates and PointSaver rates is

Cash+Points where you can redeem less points for a free night and have a

co-pay amount to make up the difference.

Here are the current Cash+Points rates:

If you take a quick look over the chart you can see that it

doesn't take a lot of points to start redeeming for free nights with

Marriott Bonvoy program but for a lot of us the highlight is being able

to use the points at the higher end hotels. So ultimately you are

looking at being able to use points to redeem for a stay at a place like

The St. Regis Maldives Vommuli Resort ![]() or The Gritti Palace, a Luxury Collection Hotel, Venice

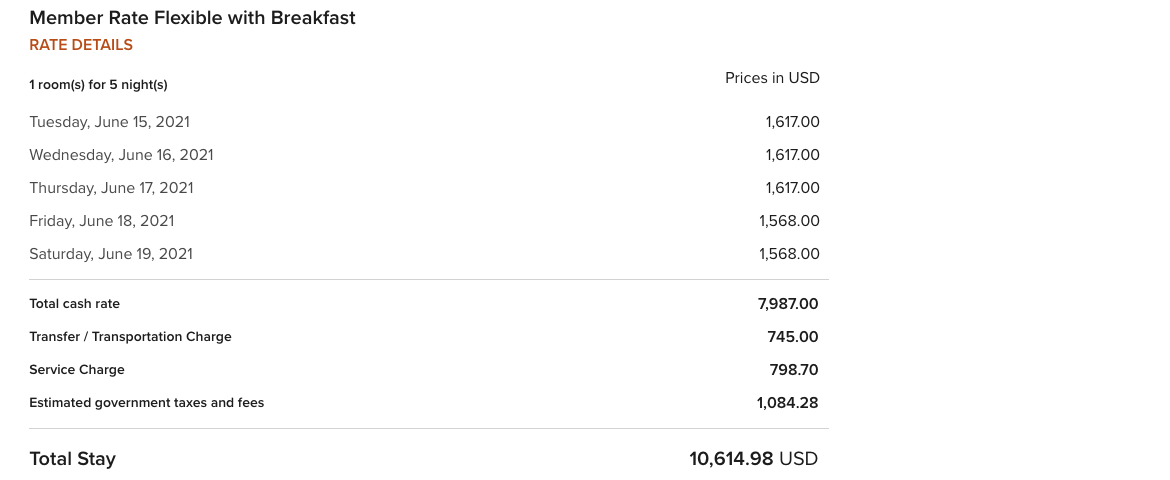

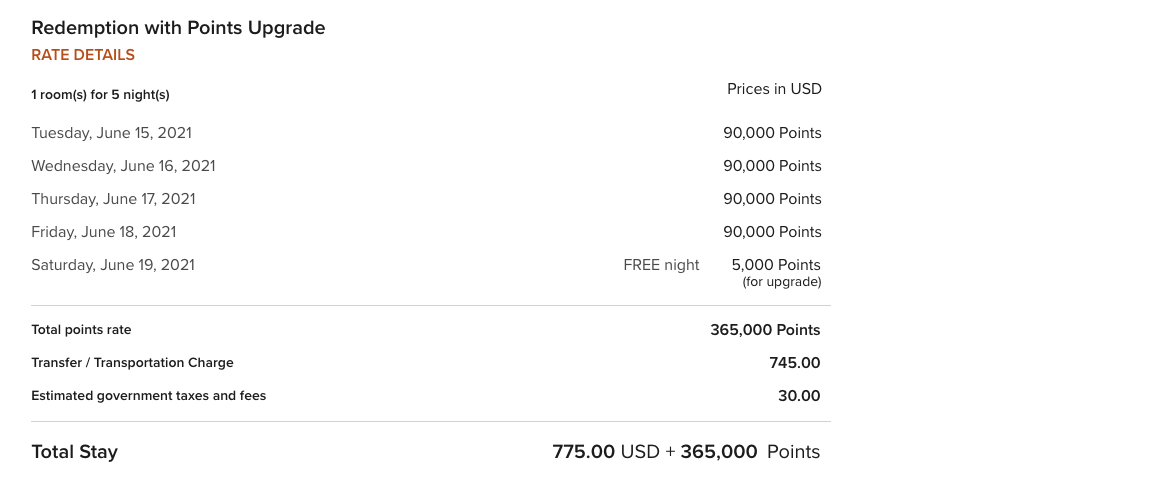

or The Gritti Palace, a Luxury Collection Hotel, Venice ![]() just to name a few! For example here's a five night stay at The St.

Regis Maldives - with points for an upgraded room and the same room with

cash rates:

just to name a few! For example here's a five night stay at The St.

Regis Maldives - with points for an upgraded room and the same room with

cash rates:

From the above example, we picked an upgraded room - an Overwater

Villa, 1 Bedroom Villa, 1 King, Sofa bed, Private pool for five nights

that cost an extra 5,000 points per night at this Category 8 hotel. That

means every night is 90,000 points instead of 85,000 but wait - you

might be asking why is it only 365,000 points and not 450,000? That

brings us the one of the best features of the Marriott Bonvoy program -

when you book 5 awards nights you get one free - the one that costs the

least of course (for example if you have a mix of off-peak and standard

rates, one of the off-peak nights would be free). It also doesn't cover

the upgrade fee in points. Any ways back to our example - you are

redeeming 365,000 points for the equivalent of US$9839.98. That works

out to 2.7 cents per point in USD or 3.4 cents per point Canadian. That

puts your 2 points per dollar earned on this card at a 6.8% return, the 3

points at 10.3% and 5 points at 17.14% - yes a 17% return on any

Marriott spending you have! That's just one

example from thousands that we could provide! Ultimately your rate of

return will be different as hotel prices are constantly changing and a

big portion of that amazing return counts on getting that 5th night

free. If you are only redeeming for three nights it drops. For the

example above it moves down to US$ 2.2 cents per points - still an

awesome return but as you can see that free night makes a huge

difference.

Recommended reading: A look at how The Marriott Bonvoy American Express Card provides huge value!

Now onto the next best redemption option

from the Marriott Bonvoy program and that's the transfer option to over

40 airline frequent flyer programs. It is more than well known

in the points and miles circles that the only hotel points that have a

meaningful conversion rate to airlines are Marriott Bonvoy points. The

reason why is they have a very good conversion ratio and also provide a

bonus when redeeming enough points. The conversion ratio for most of

their airline partners is 3 to 1 with the exceptions being Air New

Zealand, JetBlue and United. The first two are based on how the points

work in their programs hence a difference while United has an special

partnership with Marriott so you get a higher conversion rate where

you'll receive 1.1 Miles for every 3 points transferred.

Now ideally, you only want to convert to airlines in 60,000 Marriott Bonvoy point increments and that's because Marriott will kick in an additional 5,000 miles or points from the partner program. For example if you convert 60,000 Bonvoy Points to Air Canada Aeroplan you'll 20,000 points from the 3:1 conversion ratio plus an extra 5,000 for a total of 25,000 Aeroplan Points. This bonus counts for all of their frequent flyer partners.

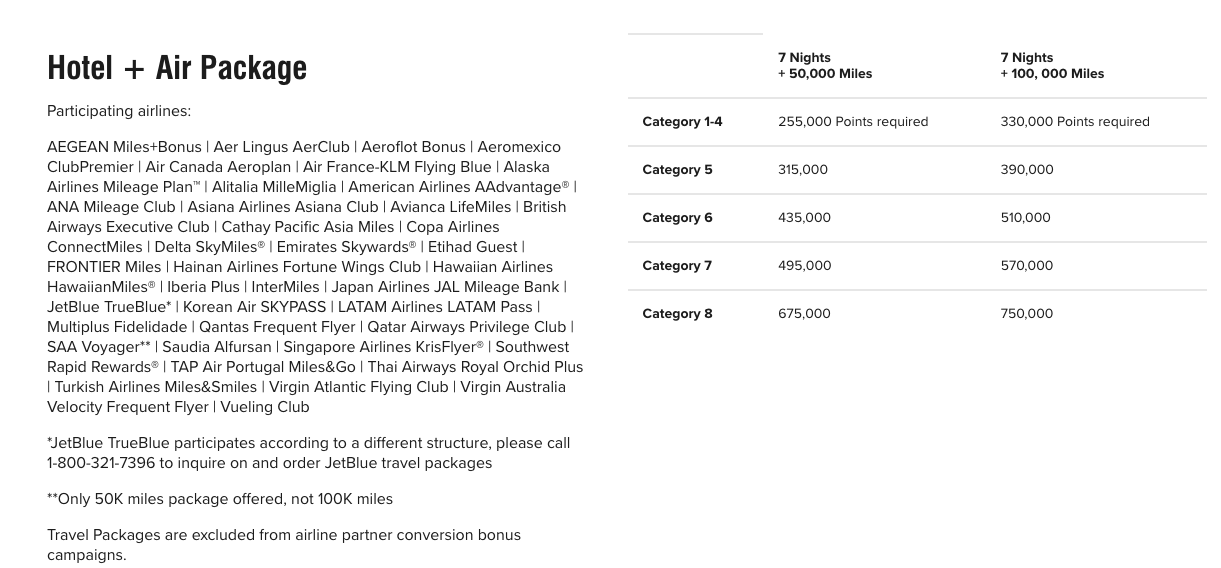

Next up you have Marriott Bonvoy Travel Packages - these used to be an amazing redemption option in the program a few years but some changes made them less attractive but in some cases they can still be a great deal. Marriott Travel Packages allow you to redeem points for 7 nights at a hotel plus airline miles to the program of your choice.

As you can see you need to redeem 750,000 points for a 7 night stay at a Category 8 hotel and get 100,000 airline miles. To do that separately it would take 835,000 points. So you can see this is where there is still some value in this package however you should do the math before redeeming for one of these travel packages to see if it is worthwhile.

You can also redeem points for flights, car rentals and gift cards - all of which provide less value than redeeming for actual hotel award nights.

Finally the last redemption option that is on hold due to the pandemic but is one to take note of once it returns are Marriott Bonvoy Moments. These are typically one of a kind experiences that you can redeem your points for. Some are auction based whereas some others a flat rate redemptions and your redeeming points for things like tickets to premium seats and suite access at the U.S. Open tennis, exclusive access to concerts, VIP access to car racing events and so much more. We'll update this review with a closer look at Moments once they become available again.

Features and Benefits

Not only does this card shine when it comes to value on the earn and burn side it is a bright light when it comes to extra benefits. The first benefit is one of the best out there in our market from any credit card available. And that benefit is an Annual Free Night Award that is provided each year on your card anniversary date. This voucher provides a free night at any Marriott hotel worldwide up to a value of 35,000 points. That means you can redeem it for up to a Category 5 hotel at a standard point level or if you are lucky enough a Category 6 hotel that is running a PointSavers rate and has Off-Peak availability. The value of this free night alone is worth more than the annual fee you pay on this card. Many Category 5 hotels cost C$200 or more per night so you can see how paying the $150 makes it worthwhile just for the free night alone!

Recommended Reading: 10 great Marriott Hotels in Canada to use your anniversary free night award from the Marriott Bonvoy American Express Card

The next feature or benefit that comes with the card is 15 elite night credits that are awarded each and every year you have the card. Those 15 nights count towards your Marriott Bonvoy elite status qualification and with Silver status only requiring 10 nights that means you automatically receive Silver status by having this card. Gold elite status requires 25 nights so you actually only have to complete 10 actual nights to earn Gold Status (or see the next benefit), 35 nights to achieve Platinum status or 60 nights to earn Titanium status.

If you spend $30,000 or more on your Marriott Bonvoy Business American Express Card each year you'll receive an upgrade to Gold elite status so this is your other option to reach this level if you can't complete the 10 additional nights as mentioned above.

On the insurance side the card comes with a standard range of coverage including travel accident insurance, flight delay, lost/stolen/delayed baggage insurance, car rental CDW coverage, hotel burglary insurance, purchase protection and extended warranty.

Finally the card provides access to Amex Offers, Amex Front

of the Line and Amex Invites. These are all exclusive programs limited

to American Express. Amex Offers is an amazing benefit that provides

statement credits or bonus points for shopping at various merchants. I

would recommend checking out our Guide to American Express Canada 'Amex Offers' ![]() for more details. Amex Front of the Line is a service that provides

presale and/or reserved ticket options for events across Canada

including concerts, theatre productions and more. Amex Invites provides

exclusive offers like advance screening for movies, exclusive shopping

events and more.

for more details. Amex Front of the Line is a service that provides

presale and/or reserved ticket options for events across Canada

including concerts, theatre productions and more. Amex Invites provides

exclusive offers like advance screening for movies, exclusive shopping

events and more.

What is good about this card

The first thing that is good about this card is the welcome bonus - 60,000 Marriott Bonvoy points are worth at least $600 in our books but if you take our Maldives example above the points can be worth $1,700!! Keeping on the topic of points the earn rates are also great - 2 points per dollar on base spending, 3 to 5 on select categories and this card provides big time value for your spending.

Next are the the benefits - the annual free night alone makes it worth it to pay the annual fee. The elite night credits and Gold status after spending $30,000 are also great benefits that come from this card.

The ability to use points for

hotel stays or convert to so many different airlines. In fact for most

of the airline partners in the Marriott Bonvoy program the only way to

earn points or miles on everyday spending in Canada is with a Marriott

Bonvoy credit card.

The Amex related benefits, mainly

Amex Offers also add to the list of good things about this card as that

can provide some much appreciated savings for cardholders.

What is not so good about this card

The annual fee at $150 is something to consider as you can get the consumer Marriott card for $120 per year for pretty much the same card. but You do lose 1 point per dollar on gas, dining and travel however if you go with the consumer card so you'll have to do the math to see which works best for you!

The fact you cannot combine the 15 elite nights earned from this card with the 15 elite nights earned from the consumer card. This is allowed in the U.S. so their members are earning 30 nights per year if they have both cards so I'm not sure why they didn't allow it here in Canada.

While amazing - your redemption options are limited. If you are someone who doesn't like to be tied into one program or that program's partners you'll be better off with a card that has more flexible reward options.

The lack of No Foreign Transaction fees - this card would

stand to benefit immensely from offering a 0% foreign transaction fee

seeing that over 7,700 of the hotels that you can earn your 5x points at

are not in Canada, So to have that extra little savings on Marriott

stays would be huge!

Who should get this card

- Marriott Bonvoy point collectors - the fact that you can have this card and the consumer card can make your Bonvoy points earn supercharged

- People who are interesting in pulling the maximum value out of each dollar they spend on their credit card

- Members of one of Marriott Bonvoy's partner airlines that have no other method of collecting points or miles in that airline program

- People who want to stay at luxurious hotels but can not typically afford paying the cash rates for those hotels

Conclusion

There's a reason why the consumer version of this card has been one of the best cards in Canada for years on end and this card is no different. It is one of the best small business cards in our market today. It has the potential to provide outsized value, I mean how many cards can give you up to 17% back on your spending? Not a whole heck of a lot of them. If you run a small business, want huge value, need a card to keep track of all your and your employees expenses and are a fan of the Marriott Bonvoy program the Marriott Bonvoy™ Business American Express® Cardis definitely one to consider.

Latest card details:

No comments:

Post a Comment