The HSBC World Elite Mastercard is a relatively new card in the Canadian market. This is not their 'Premier World Elite' which is meant for people who bank at HSBC but rather this card is for any Canadian and it is essentially the same as the Premier version. When HSBC launched this card in late 2018 it became obvious they didn't want to only market their credit cards to those who bank with them, rather they wanted to get into the entire lucrative Canadian credit card market. It was about time they did as Canadians, slow as they may have been to adapt, are learning they don't have to get credit cards from the bank they bank with, rather they can get whatever card they like and HSBC wants part of that pie.

Overview

The HSBC World Elite Mastercard is

a very strong contender in the market with its base rewards offering,

benefits and insurance package. Much like its direct competitors this

card provides utmost flexibility as it is a hybrid credit card. That is,

it has its own proprietary reward program but it also allows you to

convert point from the HSBC Rewards program to several airline frequent

flyer programs. Here at Rewards Canada, Hybrid Cards (also considered

flexiblie points) are our favourite type of credit cards.

Costs & Sign up Features

The HSBC World Elite Mastercard comes with a $149 primary card annual fee. The annual fee is slightly higher than the average seen for most other World Elite Mastercards or Visa Infinite card but not by much as many others have been increasing their fees. Don't let the annual fee sway you in anyway though as the card has lots of benefits to make up for the higher annual fee difference. Supplementary cards run $50 each. Right now, until October 31, 2022 the welcome bonus on the card is up to 80,000 HSBC Rewards points and your first year free. Those 100,000 points are worth $400 towards any travel.

The interest rate on the card

is 19.9% on purchases. 22.9% on cash advances and balance transfers.

These rates are competitive with most everyone else on the market. The

minimum annual income requirements for the card are $80,000 personal or

$150,000 household or $400,000 in assets at any Canadian Financial

Institution.

Earning

The card earns HSBC Rewards points and earns those points as follows:

- 6 points per eligible dollar spent on all eligible travel spending - This earn rate is only awarded on the first $50,000 spent in this category annually

- 3 points per dollar spent on all other spending

Point Valuation Chart

| Spending Category | Points earned per dollar spent | Rate of return when booking your own travel | Rate of return Cash Back | Rate of return when converting to airline programs |

|---|---|---|---|---|

| Travel | 6 | 3% | 1.8% | 3.6% to 12% or higher |

| All other spending | 3 | 1.5% | 0.9% | 1.8% to 6% or higher |

Redeeming

Points earned on this card are worth 0.5 cents each when redeemed for travel from any travel provider

On the redemption side, the points earned with the HSBC World Elite Mastercard can be redeemed for any travel that is booked with any provider. Simply put, you book the travel where you want and charge it to your card, you can then call up HSBC Rewards or go online to redeem your points against that travel charge. This is the same feature found on quite a few cards in Canada that have their own proprietary rewards program. One thing that does make HSBC's program different than most of the other programs is the fact that this is the only way to redeem for travel with HSBC. HSBC Rewards discontinued their own travel booking service. What this means is that you can go to any travel provider, be it an airline, hotel, all inclusive, travel agency, car rental company, you name it, you book your travel with them. he beauty of this is that you have complete control and flexibility to book the travel you want, on the days you want and choose to pay for a portion or all of it with points. Once the charge shows up you redeem your points against that charge and you may ask what is the points value associated with these redemptions. The value ranges from 1.5% to 3% of your spending, that is the 3 points per dollar you earn on the card for all purchases except for travel is worth 1.5% towards travel. Think of it this way, 1,000 points will be worth a $5 credit towards travel. For travel purchases made on the card the earn rate is double which means you are effectively getting a 3% return.

What's also cool about cards

like this one is you don't need any points at time of booking as you

have up to 60 days after the charge posts to redeem points against it.

Which means you can actually be travelling and make additional bookings

while away from home and redeem points for it at a later date.

Related: Not all Travel Points and Hybrid Credit Cards are created equal and Why proprietary credit card reward programs are the best option for most Canadians

Points can also be redeemed for many other non-travel

items like merchandise, experiences, gift cards, HSBC financial

products and even for any purchases made on the card. HSBC calls this

last option their Cash Back Rebate. The cash back rebate option is

25,000 points for a $75 statement credit. That works out to a 0.9% to

1.8% return (based on 3 points for everyday spending and 6 points for

travel)

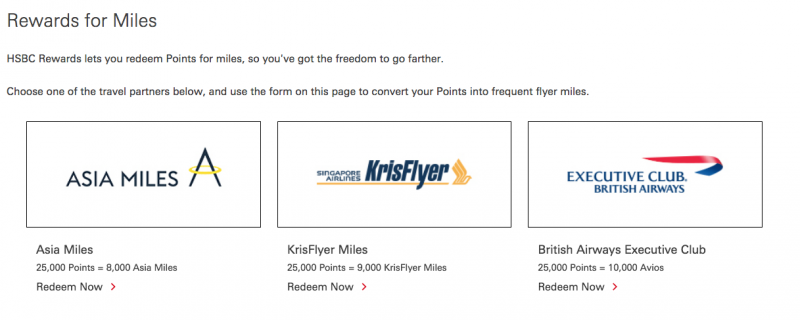

Finally, another huge benefit to the redemption side of

this card is the ability to convert to HSBC Rewards Points to various

frequent flyer programs. At the time of writing you can convert HSBC

Rewards Points to British Airways Executive Club, Cathay Pacific Asia

Miles and Singapore Airlines KrisFlyer. The conversion rates are as

follows:

- 25,000 points to 10,000 Avios

- 25,000 points to 9,000 KrisFlyer Miles

- 25,000 points to 8,000 Asia Miles

This means the card earns 0.96 to 1.92 Asia Miles per

dollar spent, 1.08 to 2.16 KrisFlyer Miles per dollar spent and 1.2 to

2.4 Avios per dollar spent. Those are some pretty good earn rates for

these programs. It basically earns more than the RBC British Airways

Visa card!

Features and Benefits

The number one feature of the HSBC World Elite Mastercard

that most people will be getting this card for is the No Foreign

Transaction fee benefit. Most cards in Canada charge between 2% and 3%

on purchases that are made in a foreign currency. This can provide a significant savings if you make a lot of purchases in US$, Euros or any other currency.

Related: No Foreign Transaction Fee Credit Cards for Canadians

Another key benefit of this card is the $100 annual travel enhancement credit. This is a credit that can be used towards travel related charges like seat selection fees, baggage fees, lounge access passes and more. The credit renews on the card anniversary date each year.

On the insurance side of benefits the card has the full slate of coverage that can be expected with a premium travel card. It has the standard Travel Accident, and Car Rental insurance. On top of that it has Trip Cancellation and Interruption insurance as well as a really good 31 day out-of-province emergency medical insurance benefit for those up to 65 years old.

As with the majority of World

Elite Mastercards in Canada, the card offers Mastercard TravelPass by DragonPAss. This means you get free membership

in DragonPass which is a lounge access program that is pretty much the

same as Priority Pass. While the

card covers your annual membership it does not cover the actual lounge

visit fees which are currently US$32 per person.

Related: Rewards Canada's Guide to Business Class Lounge Access

Finally another benefit to be aware of with this card is unlimited free Wi-Fi through Boingo at over 1 million hotspots worldwide for up to four devices and this includes several airlines such as WestJet.

What is good about this card

The best thing about the HSBC World Elite Mastercard

is the no foreign transaction fee benefit. Whether you travel lots

outside Canada, shop online a ton from the U.S. or import goods for you

business, being able to save 2 to 3% on each transaction is a huge deal.

The annual travel enhancement credit is also a good thing this card

comes with as it can provide some nice savings when travelling if you

check bags, have to pay for seat assignments (or things like upgrades to

Premium on WestJet)

The earn rate for travel expenses on the card is also another good

feature of the card. The entire card earn rates of 3 points and 6 points

per dollar are especially good if you convert to any of the card's

three airline partners as they can provide outsized value when redeeming

for business or first class.

The card also has a pretty strong insurance package including

trip cancellation and up to 31 days of out of province emergency medical

coverage for those under 65 years old.

What is not so good about this card

There isn't too much that is bad about the HSBC World Elite Mastercard, probably our biggest gripe is the earn rate on the card. Don't get us wrong, it's not that bad when you take in to account all the benefits and features of this card, like we've said it's a pretty strong contender but when looking at non-travel spending earn rate only, this card comes up short when you compare it to some other cards. Most people who have this card will be earning 3 points per dollar which translates to a 1.5% return and there are lots of cards that offer more than that for non-travel spending.

The 60 day redemption limit for using points to pay for any travel is

on the low end. Competitors of this card offer 90 days, 9 months and

even 12 months of time to where you can use points to redeem against a

travel charge.

There is no flight delay insurance. Once again most of its

competitors have this insurance included that if your flight is delayed

(typically 4-6 hours) you can start buying food, etc. and the credit

card will reimburse those charges for you.

Finally the annual fees are higher than many comparable cards at

$149 versus $120 to $139 and $50 for supplementary cards when there are similar

competitors that offer the first supplementary card for free.

Who should get this card

- Consumers who have a lot of foreign currency spending. Whether that's through travel, online shopping or even importing goods for your business from out of Canada.

- Consumers who purchase a lot of travel (up to $50,000 per year)

- Consumers who bank at HSBC and want to keep all financial products with one bank (especially if your accounts give you that card for free)

- Consumers who want the utmost in flexibility with their points, that is making their own travel bookings and using the points for those bookings or travellers/frequent flyers who are members of any of the airline programs HSBC partners with.

- Consumers who want a strong insurance package combined with lots of the above features

- British Airways Executive Club members looking for a card with strong Avios earning that isn't an Amex card

Conclusion

Years ago we wrote a piece on how credit cards in Canada didn't have No Foreign Transaction Fees and why the trend that was seen in the U.S. wasn't seen here. Well that trend is slowly emerging here. Credit card issuers in Canada are finally giving up that piece of the revenue pie that is the Foreign Transaction Fee. Until 2018 there were only a few small players in our market that offered the No FX Fee benefit but we have stated all along that as soon as one major player begins offering No FX Fees we'll see other follow suit. HSBC isn't considered a major player in our market, at least not yet, but that's because of how they used to market their cards. Now that they are after the Canadian public with this card it is bound to change. With this card and Scotia having No FX cards we hope it won't be too much longer before we see other major card issuers in Canada head down the no FX fee route as well.

In conclusion, this card is great for the person who travels a lot and has a lot of that travel outside of the country. 6 points per dollar on travel spending and no FX fees should really appeal to the international traveller. Not only that, it is a card that should be eyed by someone who makes lots of online purchases from outside of Canada thanks to the no FX fee and also for those looking for utmost in flexibility offered by a hybrid card. All in all this card is a big time contender in our market and that's why we rank it as the fifth best overall travel rewards card in Canada and third best hybrid card.

Latest card details:

• Welcome bonus of 20,000 points* ($100 travel value) • Earn 40,000 points* when you spend $6,000 within 6 months of account opening ($200 travel value) • Earn 20,000 points* as an anniversary bonus ($100 travel value) • First year annual fee rebate for the primary cardholder* ($149) • Receive a $100 annual travel enhancement credit* • Earn 3% in travel rewards on all eligible

travel purchases (6 Points per $1) and earn 1.5% in travel rewards on

all other eligible purchases (3 Points per $1)

|

Other cards to consider if you are looking at this card:

American Express Cobalt Card

American Express Gold Rewards Card

Brim Financial Mastercards

Home Trust Preferred Visa Card

mbna Rewards World Elite Mastercard

Rogers World Elite Mastercard

Scotiabank Gold American Express Card

Scotiabank Passport Visa Infinite card

No comments:

Post a Comment